Written by: Fiona Smith, Executive Contributor

Executive Contributors at Brainz Magazine are handpicked and invited to contribute because of their knowledge and valuable insight within their area of expertise.

With record breaking inflation, geopolitical tensions, and Midterm elections around the corner, it's no wonder one of the biggest concerns of the American consumer is when will the next recession begin?Market experts have publicly announced there is a strong probability for recession in the next 6 to 12 months. However, getting your investment portfolio ready for a recession requires some preparation long before the recession actually begins. In this article, you will find some tips that could help you prepare your investment portfolio and ensure your overall financial picture is more resilient during the next recession.

Summary:

The best way to prepare for a recession is to have a plan in place

If you are a long-term investor, then consider investing in low-cost index funds or ETFs that capture up to the 500 largest (and historically, most stable) companies in the United States

If you want a 0% expense ratio, then consider the Fidelity(r) ZERO Large Cap Index Fund (FNILX)

Since most mutual funds may have some turnover from their fund managers, it might make sense to hold these in tax-deferred accounts to minimize your tax liability for the current year

In this article, I’m going to show you how a millennial investor is preparing her portfolio for a recession.

If you’re familiar with Millennial investors, then you’ll know that we value several things such as:

Growth

Low Costs

Transparency

These 3 values not only guide my approach to life, but they also guide my approach to investing, specifically when it comes to building my portfolio in preparation for a future market correction.

What I look for in ETFs and Mutual Funds when Preparing for a Recession

One of the first things you’ll need to know about me is that I’m a strong believer in ETF and Mutual Fund investing.

In fact, I prefer investing in index funds that passively track the S&P 500 index.

And no, I’m not just following my intuition or my “gut feeling.”

There are hard, cold facts that support the idea that passive investing in ETF or mutual index funds can actually work.

First, let’s talk about the fees.

Source: Financial Times

At best, active funds and passive funds charge the same fees (which can average around 100 to 200 basis points).

However, most passive index funds (whether ETFs or mutual funds) often charge less than 20 basis points, while actively managed funds still hover above 50 basis points.

While the numbers may sound negligible, if you’re a long-term investor like me, then a difference of 50 basis points can make a very big difference.

Let me illustrate this concept for you. Here’s the base case:

Source: Omni Calculator

Let’s say you invest in the popular ETF known as SPY, which tracks the S&P500 index fund. SPY’s gross and net expense ratio is 9 basis points, so for simplicity, I’ve rounded this up to 10 basis points, as shown in the screenshot above.

If you start investing in SPY with $500,000, then you’d pay about $5 per year on a net expense ratio of 10 basis points.

Now let’s say you decided to invest in an actively managed mutual fund for 60 basis points.

Here’s how much money you’d pay on $500,000 of assets under management per year:

Source: Omni Calculator

With an expense ratio difference of just 50 basis points, you’d be paying 6 times more per year.

Now imagine if you compounded the difference that you would be paying between the investment fund costing 0.10% and the fund costing 0.60% over the next several decades of your working career.

These seemingly “small” numbers can actually turn into quite major investment expenses – and ultimately eat into your bottom line net returns.

It’s not just my millennial mindset that has guided me to invest in index funds over actively managed funds.

In fact, trends indicate that a majority of American investors are starting to move their assets to passive index funds, such as the S&P 500.

While passive management may not always be the best investment strategy, it certainly shows results over the active management strategy.

And that’s the second point of my argument for investing in index funds like the S&P 500: Performance.

First, it should be noted that in 2021, about 75% of day traders failed to beat the S&P 500. In fact, according to a study by Bank of America, just 1% of fund managers focused on growth outperformed the S&P 500.

Source: Financial Times

In the scenario illustrated above, most fund managers did not seek (and capture) the available alpha.

However, for value fund managers, the narrative was a little different, with many concentrating on the financials, and energy industry, which showed positive returns in 2021.

Second, active management may outperform passive management during the short term, but the probability for actively managed funds to consistently decreases significantly with each passing year.

Source: The Economist

Since working professionals like myself and other Millennials still have several decades ahead of us before retiring and making use of our investments, it is important to me to

perform consistently in line with the markets rather than having 1 outlier year in performance metrics but then lagging behind all other years due to incorrect assumptions and high expense ratios.

Third, I consider the volatility of the investments that I select for my portfolio. While I know that as a young investor, I have time on my side, so volatility shouldn’t really matter, my personal preference is to invest in assets that show consistent growth over time.

And once again, that’s where reputable indices like the S&P 500 come into play. A common measure of volatility is calculating an asset’s standard deviation. The higher the standard deviation, the more volatile.

If an asset has a standard deviation of 0, then that asset’s returns would be consistent (like earning a 0.01% interest rate in your checking account).

Below is a rough estimate of the standard deviations of the S&P 500 versus actively managed mutual funds:

5-Year S&P 500 Standard Deviation | 14.98 |

5-Year Actively Managed Fund | 30 |

Over a period of 5 years, the standard deviation for some actively managed funds can be more than 2 times higher (and thus, more volatile) than passively managed index funds.

Take a look at the SWPPX index mutual fund’s 5-year standard deviation of 14.98 below.

Source: Yahoo Finance

SWPPX’s standard deviation is much lower than ARKK’s 5-year standard deviation.

Source: Yahoo Finance

However, one should also note thatSWPPX’s alpha is slightly negative (which means SWPPX slightly underperformed the benchmark) while ARKK’s alpha is positive, which means ARKK has outperformed its index.

As you can see, there are so many different metrics you can use to evaluate an investment in your portfolio.

Whether you decide to choose an index fund or an actively managed fund really comes down to your:

Goals

Timeframe

Risk tolerance

Investment preferences

You can never go wrong with doing enough research before financially committing.

Why the S&P 500 and Why Long-Term Investing?

You’ve heard me say it before and I’ll say it again: As a Millennial investor, my goal is growth, transparency, and low fees.

That’s why I’m such a believer in the S&P 500 index and the corresponding S&P 500 index funds.

The S&P 500 is nothing more than a large basket of high-quality, domestic companies. The historical trends also indicate that the S&P 500 is a consistent and stable asset (see the previous discussion about standard deviation). In fact, investing in an index fund like the S&P 500 can help you navigate fear in this new era of uncertainty: Geopolitical, economic, industry regulation, economic developments, etc.

Source: Seeking Alpha

Since the S&P 500’s inception in 1957 through early 2022, the index has averaged roughly a 10.43% average annualized return.

Of the 500 companies represented in the S&P 500, the largest weights belong to some of the following giants:

Apple

Google

Amazon

Microsoft

Facebook

In fact, it’s mainly the tech companies that make up a large chunk of the S&P 500 composition.

Source: Statista

The tech giants that are mentioned above account for about 20% of the S&P 500’s makeup.

Since the S&P 500 offers many pros for passive investors like myself, I’m in favor of four S&P 500 funds:

SPY

VOO

FNILX

SWPPX

Personally speaking, I prefer to diversify my portfolio with both mutual funds and ETFs because I like to hedge. And while I don’t own every name that I just mentioned above in my personal portfolio at the moment, I like staying up to date.

Since I’m not the biggest fan of volatility in my personal portfolio, I hold S&P 500 mutual funds since these are traded only once per day.

My dollar cost averaging plan also purchases mutual funds over ETFs. However, since I also prefer to maintain some investments that trade in a similar capacity to stocks, I also invest in ETFs like VOO.

For those dividend investors out there, I should note that the S&P 500 probably shouldn’t be your first stop if you’re looking for dividend-producing investments.

On average, the S&P 500’s dividend yield hovers around 1.27%, which is significantly lower than other investment funds, which can offer dividend yields of up to 4% or more.

However, if you’re a young investor with many years ahead of you, then you might want to think about reinvesting your dividends instead of receiving the dividends as a direct cash payout.

Reinvesting your dividends can help you fast-track your wealth growth more than if you decided to take the cash instead.

The only downside is that unless you hold the dividend-producing assets in a tax-deferred investment account, you’ll still have to pay taxes on dividends received, regardless of whether you reinvested the dividends or took the cash option.

The Best Low-Cost Large Cap Funds [From a Millennial’s Point of View]

Two of my favorite ETFs include SPY and VOO. Both invest in the S&P500, and both trade just like stocks.

In fact, if you compare both SPY and VOO against the S&P 500 index, you’ll find that both ETFs essentially track at the same rate, with a negligible difference.

Source: Seeking Alpha

Not surprisingly, the asset that slightly outperformed both SPY and VOO was the S&P 500 index itself.

There are some minor differences between the 2 ETFs, such as:

| SPY | VOO |

Expense | 0.09% | 0.03% |

Dividend | 1.29% | 1.33% |

5-Year | 17.51% | 17.60% |

AUM | $409.98 B | $265.45 B |

Both ETFs also payout their dividends quarterly and have seen relatively steady growth. Other S&P 500 index mutual funds I’m considering for my personal portfolio also include SWPPX and FNILX.

SWPPX is the Charles Schwab S&P 500 index mutual fund. Personally, I like SWPPX because of the low expense ratio (2 basis points).

When compared to FNILX, Fidelity’s ZERO expense ratio S&P 500 index mutual fund, SWPPX actually has consistently outperformed FNILX.

Source: Seeking Alpha

Not only does it appear that SWPPX has better performance, but it also seems that SWPPX rebounds faster from periods of volatility than FNILX.

Another item to notice is that SWPPX also not only has an alpha of 0, but the mutual fund also offers a standard deviation that's lower than FNILX.

Here’s a snapshot of SWPPX:

Source: Market Watch

Now take a look at the FNILX snapshot, illustrating the lower alpha (so FNILX is underperforming the benchmark, which is the S&P 500 index in this case) and still has a higher standard deviation, which means FNILX is susceptible to more volatility.

Source: Market Watch

Even though these numbers may be very minute, over an investing time frame of several decades, those small numbers can make a significant difference.

While both SWPPX and FNILX can be considered alternatives to SPY and VOO, I still prefer to maintain a mixture of both ETFs and mutual funds.

However, it should be noted that both SWPPX and FNILXhave lower dividend yields than their ETF counterparts, but the dividends are also payout on an annual basis and not a quarterly basis.

Personally speaking, while FNILX does offer a 0% expense ratio, its performance has been underwhelming.

Below is a comparison of the 4 S&P 500 index funds, VOO, SWPPX, SPY, and FNILX, versus the S&P 500 index itself:

Source: Seeking Alpha

Once again, FNILX is the under-performer, while the other funds seem to perform in line with the S&P 500 index.

For the Tax Savvy Investors: A Tax Neutral Investing Strategy

Arguably, one of the most overlooked investment strategies is investing for tax neutrality.

If you’re not following a tax-efficient investing strategy, then not only might you be leaving extra money on the table, but you might also see taxes eating into your bottom-line net returns.

To invest efficiently from a tax perspective, you’ll likely want to place actively managed funds (such as mutual funds with higher turnover) in tax-deferred accounts such as IRAs or HSAs.

Theoretically speaking, you won’t have to pay taxes in the current year.

Let’s backtrack quickly to VOO, SWPPX, FNILX, and SPY.

When taking a look at each fund’s turnover ratio, you’ll find several key pieces of information, such as:

Whether you can expect a fund to be of a higher quality

Whether you can expect a fund to generate more short-term capital gains (which are taxed at ordinary income rates)

Here’s the breakdown of FNILX versus SWPPX:

FundName | TurnoverRatio |

SPY | 2% |

VOO | 2% |

SWPPX | 3% |

FNILX | 5% |

As you can see, it’s common for mutual funds to have a higher turnover ratio than ETFs.

In other words, mutual funds are more likely to distribute capital gains (and possibly short-term capital gains) than ETFs at the end of each year, which could signal a taxable event.

For this reason, I personally hold funds with higher turnover ratios in tax-deferred investment accounts. The ETF index funds with lower turnover numbers are held in my taxable accounts.

And although I do earn passive income from the ETFs in the form of dividend payouts, because the dividend yields are so low, the income is negligible compared to other dividend income I receive.

That’s why I hold assets such as ETFs with low dividend yields in taxable accounts. Any income generating assets that generate significant dividend income I hold in my tax-deferred accounts.

The Risks to Investing in Large Cap Mutual Funds

You’ve heard me preach about my fondness for large-cap mutual funds that track S&P500 like SWPPX and FNILX.

While both Warren Buffett and I believe that investing in the S&P 500 is a good bet, I want to make sure that I stress that large cap investing is not the only strategy you should consider for your portfolio.

In fact, investing in large-cap funds does come with some drawbacks, such as:

You shouldn’t expect to outperform the market

You may experience slow periods of growth versus if you invested in small-cap funds

Mutual index funds typically pay only annual dividends versus quarterly dividends with most ETFs

I should also note that if you decide to invest in index mutual funds, then these investments may be less liquid than their ETF counterparts.

Take a look at the comparison of AUM between ETFs and mutual funds below:

Fund Name | AUM |

SPY | $409.98 |

BVOO | $265.45 |

BSWPPX | $66.57 |

BFNILX | $5.38 |

While total assets under management (AUM) shouldn’t be the only indicator as it relates to a fund’s liquidity (or lack thereof), the AUM numbers can provide you with a good indication as to which fund(s) may offer more liquidity than others, especially during volatile market conditions.

And that idea brings me to my last point: Identifying key indicators and preparing for a recession.

Will Rate Hikes Signal a Recession?

The latest news from the Federal Reserve regarding rate hikes emerged in March of 2022, which saw the Fed announce a raise of 25 basis points of the fed funds rate.

This tightening policy is the first time the Fed has made such a move since 2018 to directly confront the record-high inflation we’ve been experiencing over the past few months.

Rate hikes can help ease supply-side frictions, especially by lowering the demand, which could help ease prices.

However, if Fed Chair Jerome Powell increases rates too fast, economic turmoil may be triggered and at the current moment, prominent economic experts already have predicted the potential for a recession in 2023 to 2024 to hover around a 50% chance.

While no one knows what will happen in the next year, let alone the next few months from now, the yield curve is a leading economic indicator that has almost always been a major signal of an impending recession.

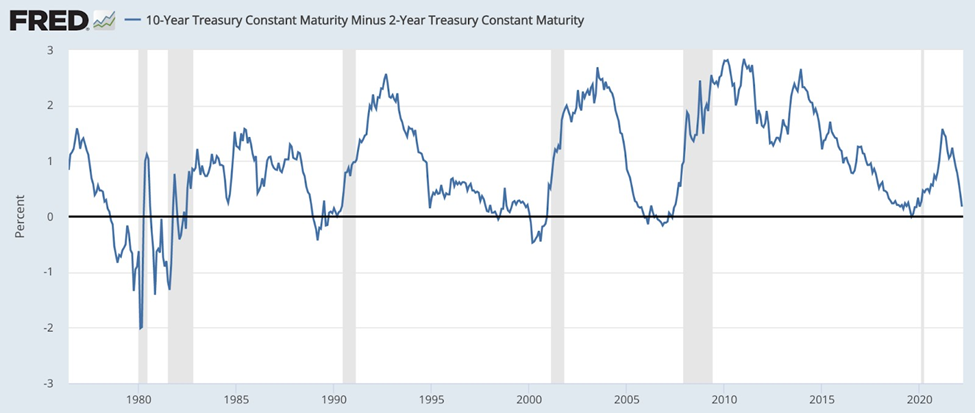

Source: FRED

Historically, if the Yield Curve is inverted, then a recession has generally followed. In fact, a yield curve inversion has accurately predicted an upcoming recession, aside from 1955.

And, in 6 of the last 13 economic cycles, the yield curve inverted within 1 year of an initial tightening move. In all inversion occurrences, the economy entered a recession within 12 to 18 months following the initial inversion.

While there still may be some debate around the length of time that a yield curve should remain inverted before signaling a recession, undoubtedly the current yield curve has been flattening and trending downward, possibly toward inversion.

Assuming the yield curve does invert in 2022, then this may be one of the strongest economic indicators that a recession may be around the corner.

Moreover, if the Fed truly wants to move forward with their 7 expected rate hikes for 2022, then it might be even more imminent for a yield curve inversion in the near future.

Other Considerations to Prepare for a Recession

Since experts do agree that a recession is very likely to occur within the next few years, I’m preparing today to optimize my finances for a future market downturn.

First, I’m a little overweight on my cash exposure. Typically, I try and keep my portfolio to about2% to 3% in cash.

However, knowing that an economic downturn is imminent, I’m slowly building my cash reserves (possibly to 10% or 20%) to take advantage of a recession. Buying when equities are “on sale” during a recession is one of the fastest and most efficient ways to build wealth over time.

Second, I’m also taking a closer look at my taxable account positions in an effort to identify investments that I could tax-loss harvest. In other words, I would analyze the capital gains and capital losses of my investments to see if I could offset gains with losses. Since markets have seen much growth over the past few years, it’s highly unlikely that I’ll find many positions with losses. However, should the economy enter a period of heavy volatility and consequently cause losses in my investments, I could immediately take advantage of tax loss harvesting. If you do plan to implement this tax-neutral strategy, just make sure you communicate with both your accountant and your wealth advisor to ensure that everyone is on the same page.

Third, while not for me at this point in my life, I would also consider making Roth IRA conversions. Typically, this strategy is reserved for someone who has a lot of pre-tax investments and is looking to build up their after-tax Roth investment accounts.

The point of a Roth conversion is to withdraw your funds from your Roth IRA during retirement without having to pay taxes. You don’t pay taxes during retirement because with a Roth conversion; you elect to pay ordinary income taxes today on the amount you convert at the historically low tax brackets we have today. On the other hand, if you leave your assets in your pre-tax account, you’ll more than likely have to pay taxes when you withdraw the funds.

While Roth conversions really shouldn’t be driven by market conditions alone, they certainly are another planning strategy that you can implement today to lower your out-of-pocket expenses tomorrow. Once again, this strategy may suit some more than others and it’s always advisable to check with your accountant and wealth advisor first before proceeding.

And finally, fourth, I’m also looking to align my inner money compass. In other words, I’m trying to better understand my own thoughts on money, my risk tolerance and of course, how I would psychologically react during a recession when I see my portfolio down by potentially 40% or more. Many investors believe that it’s so important to prepare financially speaking for a recession, and I agree that’s one piece of the puzzle. However, I also think it’s important to consider the psychological aspect since it’s not easy to see your own, hard-earned money seemingly disappear during volatile market times.

So, understand how you might react during a recession and try to prepare yourself mentally for such a downturn.

Conclusion

As a Millennial investor, I’m looking forward to an economic downturn. Why? Because it’s an opportunity to buy equities“on sale.”

I’m a bargain investor with a long-term focus, which is why I look for low-expense ratios and undervalued equities. However, the cost is not the only factor when I determine what to add to my portfolio. I also review the performance, allocation, alpha, and standard deviation to make sure the investment matches my overall risk profile.

While there are many unique investment assets and investment classes out there, I personally follow Warren Buffett’s investment advice, which is to track the S&P 500 index fund. So, I have invested in SWPPX and VOO. I’m also thinking about adding SPY along with several other ETFs to my portfolio.

Overall, however, the trick really isn’t to time the market or to carefully select an assortment of stocks. In the end, success in the stock market really does depend on consistency (how often do you invest in the stock market?) and timeframe (how long do you plan to stay invested in the stock market before withdrawing your assets?).

And ultimately, time and a long-term focus are the key ingredients to becoming a successful investor.

Fiona Smith, Executive Contributor Brainz Magazine

Fiona Smith is the founder of The Millennial Money Woman. She holds her Master of Science Degree in Personal Financial Planning and has co-founded a local non-profit community teaching financial literacy. She is the author of the personal finance book How to Get Rich from Nothing and her work is featured on Forbes, Oberlo, and FinCon.